Key

takeaways from Thorsten Heins, President and CEO of BlackBerry

- We are very disappointed with our operational and financial results this quarter and have announced a series of major changes to address the competitive hardware environment and our cost structure

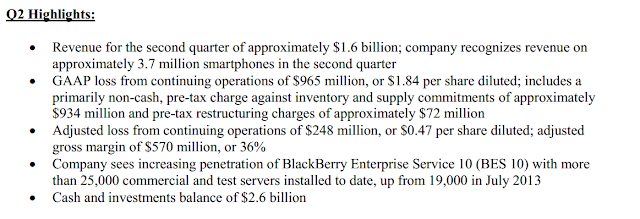

- While our company goes through the necessary changes to create the best business model for our hardware business, we continue to see confidence from our customers through the increasing penetration of BES 10, where we now have more than 25,000 commercial and test servers installed to date, up from 19,000 in July 2013.

- We understand how some of the activities we are going through create uncertainty, but we remain a financially strong company with $2.6 billion in cash and no debt.

- We are focused on our targeted markets, and are committed to completing our transition quickly in order to establish a more focused and efficient company.

During the second quarter, the company

recognized hardware revenue on approximately 3.7 million BlackBerry

smartphones. Most of the units recognized are BlackBerry 7 devices, in part

because certain BlackBerry 10 devices that were shipped in the second quarter

of fiscal 2014 will not be recognized until those devices are sold through to

end customers. During the quarter, approximately 5.9 million BlackBerry

smartphones were sold through to end customers, which included shipments made

prior to the second quarter and which reduced the Company

Revenue for Q2 of fiscal 2014 was

approximately $1.6 billion, down 49% from $3.1 billion in the previous quarter

and down 45% from $2.9 billion in the same quarter of fiscal 2013. The revenue

breakdown for the quarter was approximately 49% for hardware, 46% for service

and 5% for software and other revenue.

The GAAP loss from continuing operations

for the quarter was $965 million, or $1.84 per share diluted, including a

primarily non-cash, pre-tax charge against inventory and supply commitments of approximately

$934 million (the “Z10 Inventory Charge”), and pre-tax restructuring charges of

approximately $72 million related to the Cost Optimization and Resource

Efficiency (“CORE”) program.

This is compared with a GAAP loss from

continuing operations of $84 million, or $0.16 per share diluted in the prior

quarter and GAAP loss from continuing operations of $229 million, or $0.44 per

share diluted, in the same quarter last year.

The adjusted loss from continuing

operations for the second quarter was $248 million, or $0.47 per share diluted.

The adjusted loss from continuing operations and adjusted diluted loss per

share exclude the impact of the Z10 Inventory Charge of approximately $934

million ($666 million after tax) and pre-tax restructuring charges of

approximately $72 million ($51 million after tax) related to the CORE program incurred

in the second quarter of fiscal 2014.

These impacts on GAAP loss from

continuing operations and diluted loss per share from continuing operations are

summarized in the table below. The total of cash, cash equivalents, short-term

and long-term investments was $2.6 billion as of August 31, 2013, compared to

$3.1 billion at the end of the previous quarter. Cash flow used in operations

in the second quarter was approximately $136 million. Uses of cash included

intangible asset additions of approximately $268 million and capital

expenditures of approximately $112 million.